Investment Philosophy

Disciplined Process

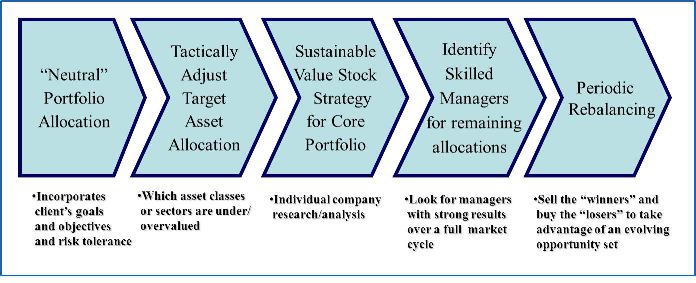

The neutral portfolio allocation is adjusted based on tactical opportunities. We consider a wide range of asset classes and sectors, seeking undervalued opportunities. In particular, we look for “fat pitches” consisting of extreme cases of undervaluation that present a high likelihood of adding value over a full market cycle.

In building and maintaining the core portfolio of individual stocks we use our Sustainable Value strategy. We utilize qualitative factors—does the company have a strong market position? Does management allocate capital wisely—along with quantitative factors, which includes reviewing five to ten years of financial information (if possible), with a focus on free cash flow and organic growth. We monitor stocks in the core portfolio carefully, including quarterly earnings releases and management conference calls.

In selecting fund managers for the remainder of a client’s portfolio we emphasize fund families with a strong shareholder orientation. These are frequently independent firms whose culture and management incentives both emphasize long-term performance. We look for a consistent track record of superior returns relative to indices and peer groups. Just as importantly, we engage in a detailed review of each manager’s investment philosophy and investment process, seeking to identify managers who are likely to continue to outperform.

We rebalance periodically in order to take advantage of evolving opportunities, avoid extreme overvaluation that could subject portfolios to permanent loss of capital, and maintain consistency with a client’s neutral allocation.