Investment Philosophy

Stocks at the Core

Stocks at the Core Investment Philosophy – Lebed Asset Management

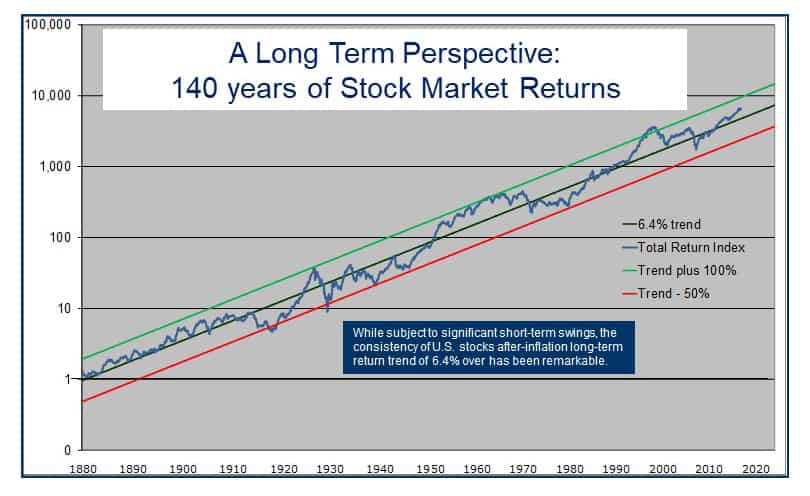

The S&P 500 Index, with dividends reinvested and inflation-adjusted, can be volatile. But it’s also been remarkably consistent: the index has almost always stayed between 50% below and 100% above its long-term trend of a 6.4% annual real return*.

This consistency and high level of average return—compare 6.4% to the real return of about 2.8% for treasury bonds over the same period—suggest that stocks are an ideal foundation for long-term investing.

*Data and chart reflect the S&P 500 Index on a total real return basis. Underlying data comes from irrationalexuberance.com by Prof. Robert Shiller. Past performance is not indicative of future returns.